A Caution From 2007: Beware of the Dividend in Your High Dividend ETFs & Funds

April 23, 2020 | ECONOMICS & INVESTING

Disclosures:

Copyright © 2020 Beaumont Capital Management (BCM). All rights reserved.

The views and opinions expressed throughout this presentation are those of the author as of April 23rd, 2020. The opinions and outlooks may change over time with changing market conditions or other relevant variables.

This material is provided for informational purposes only and does not in any sense constitute a solicitation or offer for the purchase or sale of a specific security or other investment options, nor does it constitute investment advice for any person. References to specific securities are for illustrative purposes only and are not a recommendation to take any action. OUSA is currently held in one or more of the BCM strategies.

The information presented in this report is based on data obtained from third party sources. Although it is believed to be accurate, no representation or warranty is made as to its accuracy or completeness.

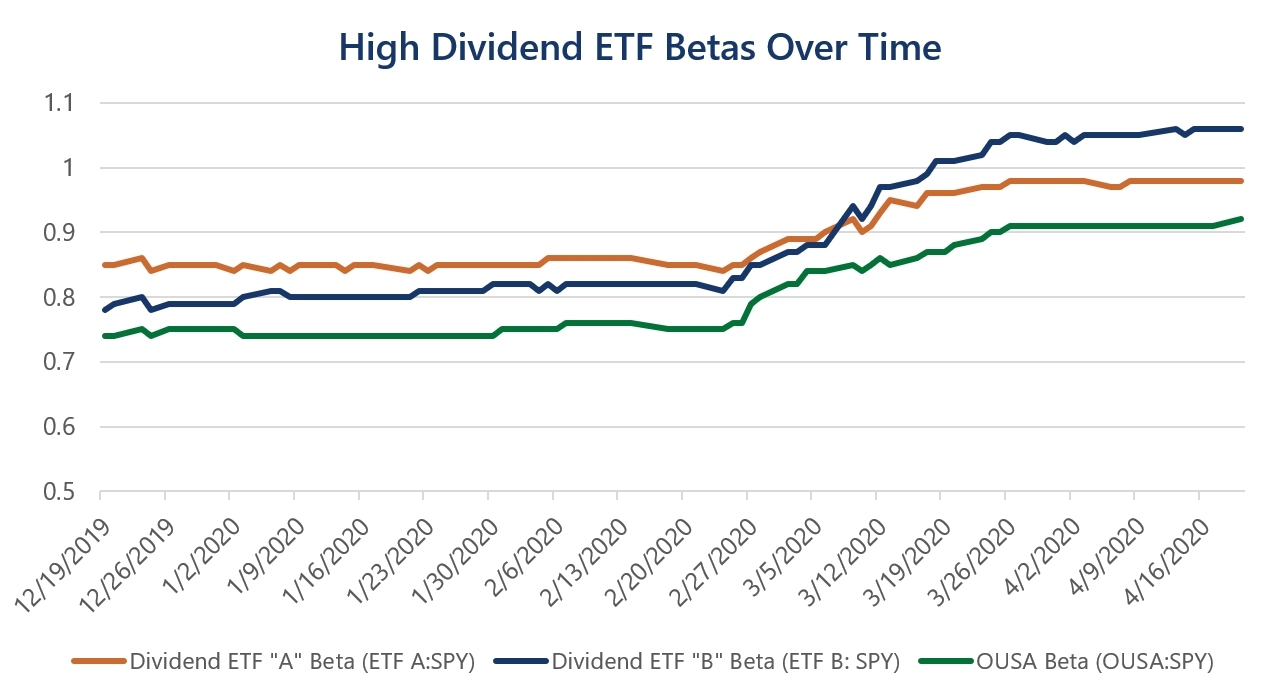

Chart titled “High Dividend ETF Betas Over Time”: “Dividend ETF ‘A’” is represented by Vanguard High Dividend Yield ETF (VYM) which is the largest U.S. Dividend ETF by AUM. “Dividend ETF ‘B’” is iShares Select Dividend ETF (DVY).

As with all investments, there are associated inherent risks including loss of principal. Stock markets, especially foreign markets, are volatile and can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments. Sector and factor investments concentrate in a particular industry or investment attribute, and the investments’ performance could depend heavily on the performance of that industry or attribute and be more volatile than the performance of less concentrated investment options and the market as a whole. Securities of companies with smaller market capitalizations tend to be more volatile and less liquid than larger company stocks. Foreign markets, particularly emerging markets, can be more volatile than U.S. markets due to increased political, regulatory, social or economic uncertainties. Fixed Income investments have exposure to credit, interest rate, market, and inflation risk. Diversification does not ensure a profit or guarantee against a loss.

Past performance is no guarantee of future results. ETF performance shown is gross of fees and expenses. An investment cannot be made directly in an index. Individual securities mentioned may be held in client accounts. Index performance is gross.

Beta is a measure of the volatility, or systematic risk, of a security or portfolio, in comparison to the market as a whole. Beta describes the activity of a security’s returns responding to swings in the market. The beta calculation is used to help investors understand whether a stock moves in the same direction as the rest of the market, and how volatile (risky) it is compared to the market.

All BCM strategies invest solely in long-only ETFs.