Written by David Haviland

Factor Investing: Smart Beta Pursuing Alpha

September 28, 2018 | ECONOMICS & INVESTING

In the spectrum of investing from passive (index based) to active management there are no shortage of considerations. Passive tends to be cheaper and should deliver returns very close to the index it tracks, which is great in up markets, less so in down markets. Active tends to be more expensive and relies on the skill of the portfolio manager(s) to deliver desirable results.

Factor investing is a blended approach which may be best characterized by the popularly used phrase ‘smart beta’.

Factor investing refers to a passive, rules-based approach where the burden of management has been shifted to a researched process attempting to provide value (perhaps greater return and/or with less risk). For example, the S&P 500® Index, which is a market capitalization (cap) weighted index, can be purchased in an ETF tracking this index at a very low cost and provides nearly identical performance to the S&P 500 itself.

Alternatively, one can purchase an equal-weighted version of the S&P 500 index as an ETF which delivers a different return stream that may be beneficial to an investor when smaller cap stocks outperform. By simply changing market cap to equal weight, a ‘smart beta’ investment has been created. With the proliferation of so-called smart beta approaches it can be overwhelming to even begin exploring the vastness of these methodologies. The purpose of this paper is to explore a subset of the smart beta universe that specifically focuses on factor investing.

What is a factor?

“A factor can be thought of as any characteristic relating a group of securities that is important in explaining their return and risk…one view is that factor returns are compensation for bearing systematic risk…the market can be viewed as the first and most important equity factor…researchers generally look for factors that are persistent over time and have strong explanatory power over a broad range of stocks.”¹

How many factors are there?

Factor research began in earnest with the capital asset pricing model (CAPM) of Treynor (1961) and continued with Sharpe (1964), Lintner (1965), and Mossin (1966). The model proposes that the return on an investment is a function of its sensitivity to market risk, so that an investment with a high exposure to market risk, or a high beta, should earn higher returns. The CAPM is a single-factor framework whereby the only risk that should be rewarded is market risk.² ³

Many others including Fama and French have built upon this initial work and the notion that certain characteristics found in a group of securities can explain the corresponding return and risk of the securities.4 Not surprisingly, academics and practitioners alike have attempted to explore the possibility of even larger numbers of factors. One recent study examined 316 factors from over 400 research papers only to find that many do not pass a test of statistical significance.5

Most research on factor investing has determined six equity factors of significance: value, size, momentum, low volatility, dividend yield, and quality. The exact definition of each is not universal, but at a high level they are generally similar in design. The following table6 from MSCI summarizes this:

Are Factor Returns Persistent?

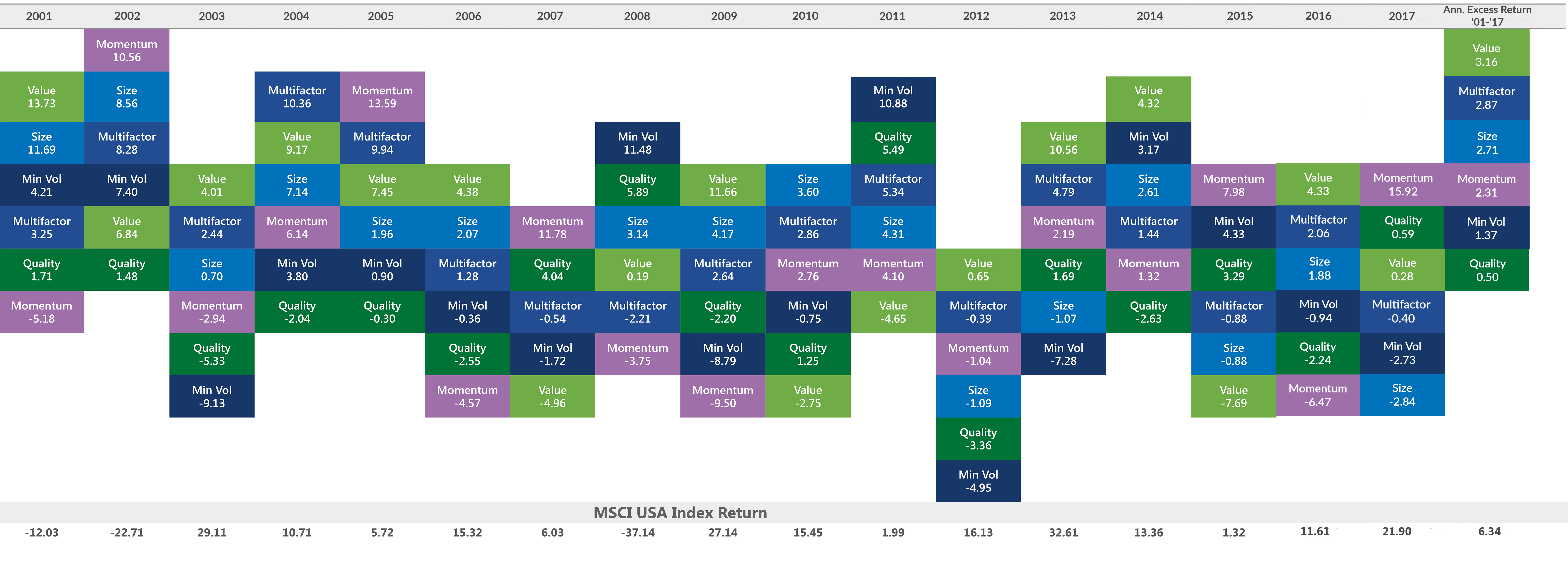

A common question and ongoing debate is whether factor returns can persist. If there is support both from a logic and research basis about a persistent, desirable return simply by investing in a group of stocks with similar characteristics, then why wouldn’t everyone invest in these stocks? Perhaps they do. After all, if everyone is aware of a trade that makes you richer, then in theory everyone will attempt to exploit it, eventually negating its existence. It is therefore reasonable to assume that like all other facets of investing, there is the risk of losing principal. Examining long-short factor indexes that attempt to isolate the factor return shows indeed that factors don’t always pay you for holding them. In addition, there are many economic and market forces that supersede or overwhelm a factor’s performance over short periods of time. Therefore, an investment in a factor may need to be held long-term to show its potential value-add or conversely, bought and sold when the factor opportunities are greatest. As the chart below shows, factors have good years and bad. This creates opportunity!

How to Allocate to Factors?

Given that factors, like all other investments, may have good and bad periods, a processmust be in place for determining how to allocate to the factors. This may be as simple as anequal-weight buy and hold approach, or a more dynamic approach to tilt the portfolio towards those factors that are likely to outperform and reduce or eliminate those that are likely to underperform. Whichever approach is taken, it still may not be enough to weather all circumstances. As you may recall from the Global Financial Crisis in 2007-09, there are periods of market turmoil where nearly all asset classes correlate to one when investors panic and sell off almost everything they own. In these situations, all factors are likely to lose significant value, some less than others perhaps, but devastating nevertheless. The S&P 500 Total Return Index suffered a 50.9% drawdown from its peak in late 2007 to its depths in early 2009; while an equal-weighted portfolio of six factor ETFs suffered a virtually identical 50.8% drawdown. Yet, over a longer time period, around 24 years, this equal weight portfolio delivered 2.0% annualized better performance with slightly less volatility.7 Therefore a

process of reducing exposure to most or all factors during times of market failure can add significant value.

How to invest in factors while mitigating the potential for large drawdowns?

When markets enter a period of failure, most humans react in a similar and predictable fashion: they panic and sell. Hence market volatility can produce a predictable circumstance or regime. If these regimes can be predicted, then a valuable overlay to the dynamic approach mentioned above can be created. In these circumstances the factor investment can be sold and the proceeds allocated to the remaining factors and/or used to raise cash in the portfolio until it’s safe to reinvest. An approach like this may be capable of delivering similar returns with less volatility and lower portfolio drawdowns. That’s how factors, or “smart beta”, can be used to generate “dumb” alpha.

Sources and Disclosures:

1 MSCI, Foundations of Factor Investing. December 2013

2 Vanguard, Factor-based investing. April 2015.

3 Fama, Eugene F., and Kenneth R. French, 1992. The Cross-Section of Expected Stock Returns. Journal of Finance 47:427–65.

4 Fama, Eugene F., and Kenneth R. French, 1993. Common Risk Factors in the Returns on Stock and Bonds. Journal of Financial Economics 33: 3–56.

5 Harvey, Campbell R., Yan Liu, and HeqingZhu. 2014. “…and the Cross-Section of Expected Returns.”

6 MSCI, Foundations of Factor Investing. December 2013

7 Source: Bloomberg, BCM Research. Longer time period was selected as the longest time series for which all six factor

indexes had available data concurrently.

Copyright © 2018 Beaumont Financial Partners, LLC DBA Beaumont Capital Management (BCM). All rights reserved.

This material is provided for informational purposes only and does not in any sense constitute a solicitation or offer for the purchase or sale of securities nor does it constitute investment advice for any person. It has been obtained from sources we deem to be reliable, but its accuracy and completeness are not guaranteed.

Past performance is no guarantee of future results. Diversification does not ensure a profit or guarantee against a loss. An investment cannot be made directly in an index.

The Standard & Poor’s (S&P) 500® Index is an unmanaged index that tracks the performance of 500 widely held, large-capitalization U.S. stocks. Indices are not managed and do not incur fees or expenses. “S&P 500®” is the registered mark of Standard & Poor’s Financial Services, LLC .

MSCI USA Index is designed to measure the performance of the large and mid cap segments of the US market. With 620 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in the US.

The MSCI USA Momentum Index is based on MSCI USA Index, its parent index, which captures large and mid cap stocks of the US market. It is designed to reflect the performance of an equity momentum strategy by emphasizing stocks with high price momentum, while maintaining reasonably high trading liquidity, investment capacity and moderate index turnover.

The MSCI USA Enhanced Value Index captures large and mid-cap representation across the US equity markets exhibiting overall value style characteristics. The index is designed to represent the performance of securities that exhibit higher value characteristics relative to their peers within the corresponding GICS® sector. The value investment style characteristics for index construction are defined using three variables:

Price-to-Book Value, Price-to-Forward Earnings and Enterprise Value-to-Cash flow from Operations.

The MSCI USA Risk Weighted Index is based on a traditional market cap weighted parent index, the MSCI USA Index, which includes US large and mid cap stocks. Constructed using a simple, but effective and transparent process, the MSCI USA Risk Weighted Index reweights each security of the parent index so that stocks with lower risk are given higher index weights. The index seeks to emphasize stocks with lower historical return variance and tends to have a bias towards lower size and lower risk stocks.

The MSCI USA Sector Neutral Quality Index captures large and mid-cap representation across the US equity markets. The index aims to capture the performance of securities that exhibit stronger quality characteristics relative to their peers within the same GICS® sector by identifying stocks with high quality scores based on three main fundamental variables: high Return-on-Equity (ROE), low leverage and low earnings variability.

The MSCI USA Minimum Volatility (USD) Index aims to reflect the performance characteristics of a minimum variance strategy applied to the large and mid cap USA equity universe. The index is calculated by optimizing the MSCI USA Index, its parent index, in USD for the lowest “absolute risk (within a given set ofconstraints).

The views and opinions expressed throughout this paper are those of the author as of August 2018. The opinions and outlooks may change over time with changing market conditions or other relevant variables.

This material is provided for informational purposes only and does not in any sense constitute a solicitation or offer for the purchase or sale of securities nor does it constitute investment advice for any person.

Popular Posts

- Mini-Cycles, Manufacturing, and Mounting Debt

- ‘De-Worsifying’ Equities, U.S. Dividends Fail to Measure Up, and Are Junk Bond ETFs Turning to Junk?

- 2Q24 Market & Strategy Review: Betting on Broadening

- Factor Investing: Smart Beta Pursuing Alpha

- Tactical to Practical: Understanding the Importance of Types of Market Declines