Written by David Haviland

It’s Time to Talk About the R-Word

December 18, 2018 | ECONOMICS & INVESTING

As we frequently like to point out, no one knows what will happen to the markets or the economy over the short term. Not tomorrow, next week, next quarter or even next year. But we do need to face reality. The bull market that we have enjoyed since 2009 is the longest in history. The economic expansion during the same time frame, although weaker than most, is soon to be the longest ever. Let me state the obvious: Every day that goes by means we are closer to these events ending. Perhaps they already have.

It is rare that anyone can identify the cause or causes of a recession. However, if we’re currently heading towards a recession, the reason looks pretty damn obvious: The trade war and Central Bank actions have combined to provide an economic poison that is rapidly killing global economic trade and growth. The stock markets are a forward-looking mechanism and collectively, investors look to future earnings to determine their buy and sell decisions. With this in mind, let’s explore the reasons for caution and hopefully motivate our readers to take protective action with their portfolios…and soon.

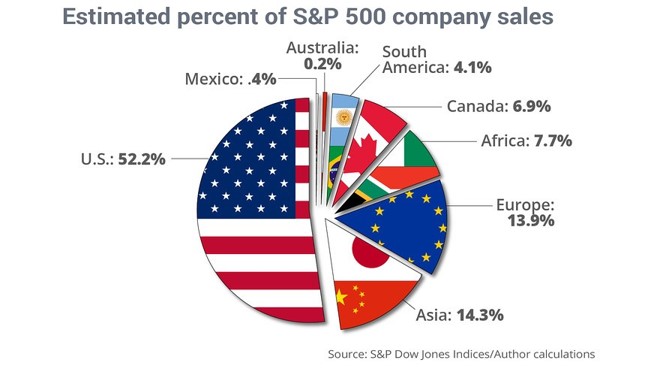

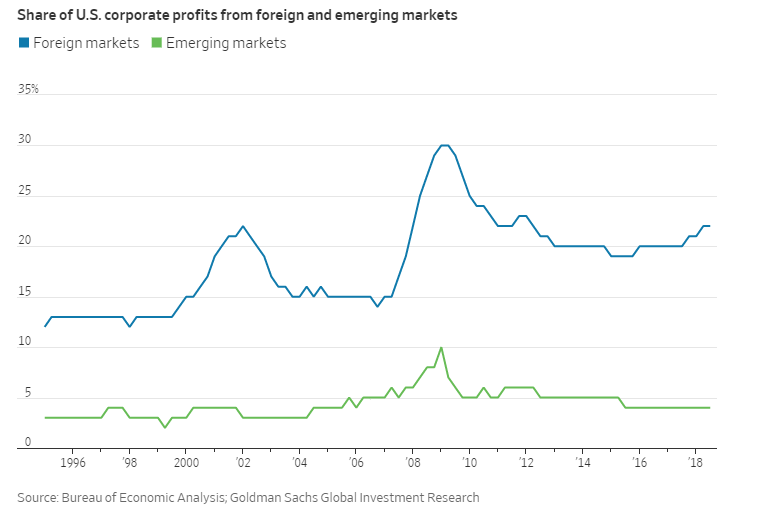

1. We have written and blogged extensively about tariffs and their devastating effect on global trade. At the beginning of 2018 when 98% of all OECD (Organisation for Economic Co-Operation and Development) countries, and the 70 satellite countries, showed positive Leading Economic Indicators (LEI’s), positive GDP growth and thriving trade, at the end of 2018, this number fell to 68%, and the trend, outside the U.S., is decidedly down. Put simply, the trade war has devastated most emerging and developed economies and many are seeing their manufacturing, trade and GDP growth rates all decline. Since ~48% of the sales and ~25% of the profits of the S&P 500® Index are from overseas, this does not bode well for the S&P 500’s results going forward.

Source: S&P Dow Jones Indices

Source: Bureau of Economic Analysis; Goldman Sachs Global Investment Research

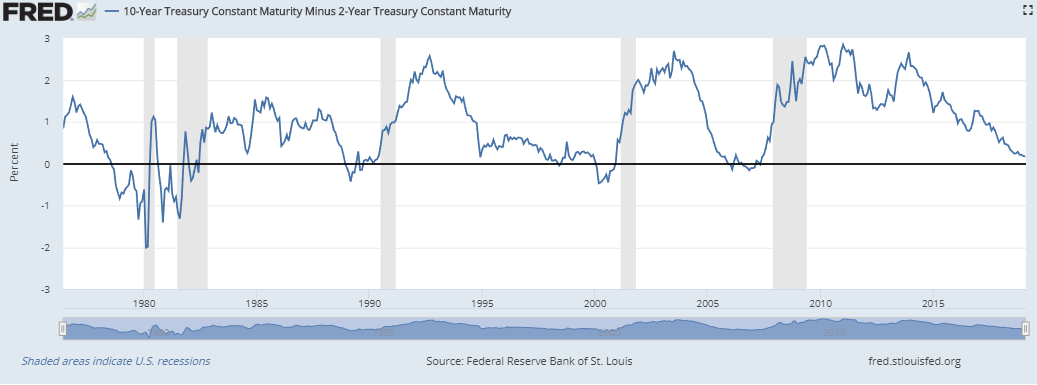

2. Since WWII, a recession has followed a 2-year to 10-year UST yield curve inversion within 12-24 months each and every time (Dips below the black line in the chart below). In the beginning of December, the 2-year to 7-year UST yield inverted. As of this writing, the 2-year to 10-year UST is on the verge of inverting. Inversion implies that investors see the more current economic conditions to be better (higher interest rates) than future economic conditions (with lower interest rates due to worse economic conditions).

3. Since the founding of the FED in 1913, a market correction or worse has occurred 82% of the time shortly after the FED entered into a rate hiking cycle. Rate increases, especially when they occur in rapid succession, are a tool used by the FED to slow the economy and keep inflation in check. Yet the FED tends to go “too far, too fast” and winds up ending the economic expansion. For example, in 2004-06 the FED raised rates by .25% seventeen meetings in a row. Many view the aggressive rate hikes as the spark that lit the powder keg for the great Recession that followed.

Recently the Fed has taken a most welcome change in policy stance, by stating they will “pause” on increasing rates further.

4. Central Bank Quantitative Easing (QE) has turned into QE reversal. This is the first time QE has been used on such a scale. QE was a new tool used by the FED and is somewhat of an experiment that has yet to conclude. Just as QE was stimulative to the economy, the reversal or withdrawal of QE should act as a depressant to economic activity.

The Fed also expressed their willingness to lessen or end QE reversal although there are no signs this has happened yet. So far QE reversal has put 2.5 trillion back into the market.

5. Higher interest rates have taken an anemic housing recovery and stopped it in its tracks. Note that the Great Recession depressed housing to modern era lows and the recovery is barely above the troughs of previous housing recessions. New housing is essential to the economy as it employs the trades during construction, fosters durable goods manufacturing (refrigerators, hot water heaters, etc.), drives consumerism (you fill the house with curtains, furniture, etc.) and even helps trades post construction like landscapers. The lackluster recovery has certainly contributed to the current expansion’s mediocre pace.

Source: Thechartstore.com as of 11/30/18

But the recent rise in interest rates has also braked refinancing and slowed existing home sales. Note the scale below is in 2 million home sale increments and represents a significant decrease in home sales.

6. According to Bankrates’s 2Q18 survey of economists, 77% expect that a recession will occur in the next three years. One-third expect it within two years. As the chart from Guggenheim Investments shows, the average drawdown of the S&P 500 in a recession is 27%!

The drawdown data below only represents the drawdown from the 52 week highs. Since bear markets tend to last longer than 52 weeks, the real number is almost certainly larger.

As I pointed out in the introduction to this piece, we don’t know for sure that we’re heading towards a recession. What we believe is that we can no longer take the health of the U.S. economy for granted. If you’ve come to this same conclusion, what should you do?

We’re obviously biased but we believe the answer is to consider adding tactical managers to your portfolio. Many tactical managers can adapt rapidly to changing market conditions by rotating among asset classes, and in some cases adding significant cash allocations to the portfolio. But they do so using a disciplined, repeatable process rather than making emotionally-driven investment decisions. These are the characteristics that you’ll want in an investment manager if tough times are ahead.

Sources and Disclosures:

Copyright © 2018 Beaumont Financial Partners, LLC DBA Beaumont Capital Management (BCM). All rights reserved.

The views and opinions expressed throughout this paper are those of the author as of December 2018. The opinions and outlooks may change over time with changing market conditions or other relevant variables.

The information presented in this report is based on data obtained from third party sources. Although it is believed to be accurate, no representation or warranty is made as to its accuracy or completeness.

This material is provided for informational purposes only and does not in any sense constitute a solicitation or offer for the purchase or sale of securities nor should it be construed as investment advice. Past performance is no guarantee of future results. An investment cannot be made directly in an index.

“S&P 500®” is a registered trademark of Standard & Poor’s, Inc., a division of S&P Global Inc.

Performance data shown represents past performance and is no guarantee of future results.

As with all investments, there are associated inherent risks including loss of principal. Stock markets, especially foreign markets, are volatile and can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments. Sector investments concentrate in a particular industry, and the investments’ performance could depend heavily on the performance of that industry and be more volatile than the performance of less concentrated investment options. Foreign securities are subject to interest rate, currency exchange rate, economic, and political risks, all of which are magnified in emerging markets. The risks are particularly significant for ETFs that focus on a single country or region. The ETF may have additional volatility because it may be comprised significantly of assets in securities of a small number of individual issuers.

The portfolio manager maintains full discretion over the portfolio.

Popular Posts

- Mini-Cycles, Manufacturing, and Mounting Debt

- ‘De-Worsifying’ Equities, U.S. Dividends Fail to Measure Up, and Are Junk Bond ETFs Turning to Junk?

- Factor Investing: Smart Beta Pursuing Alpha

- The Election, Interest Rates, Nuclear Energy

- Tactical to Practical: Understanding the Importance of Types of Market Declines