The U.S. unemployment rate fell below 10% for the first tine since March last month, but a politicized process—and a week-over-week rise in new claims—is undercutting confidence in the recovery. Equities had their own crisis of confidence yesterday with Big Tech leading the major U.S. indices to their sharpest losses in months—is it just a natural (and healthy) pullback or a sign of trouble ahead? And global manufacturing has fully recovered to pre-pandemic levels, but is it sustainable when second waves of infection are taking hold and many economists are bracing for a “double-dip” recession?

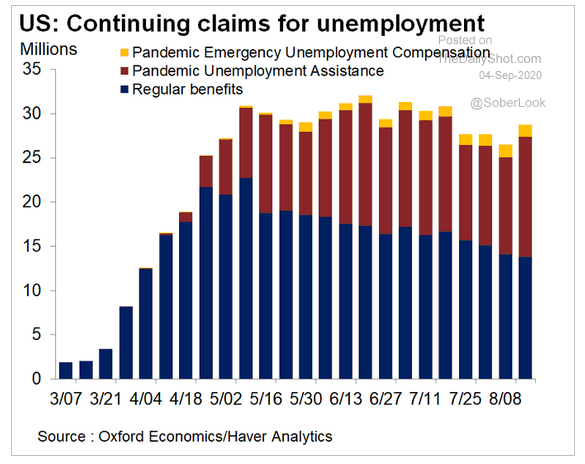

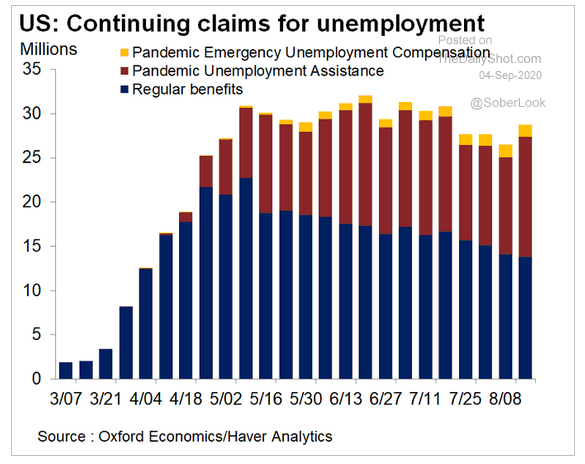

1. Regardless of how we count, there are still a sobering ~30 million Americans out of work…

Source: The Daily Shot, from 9/4/20

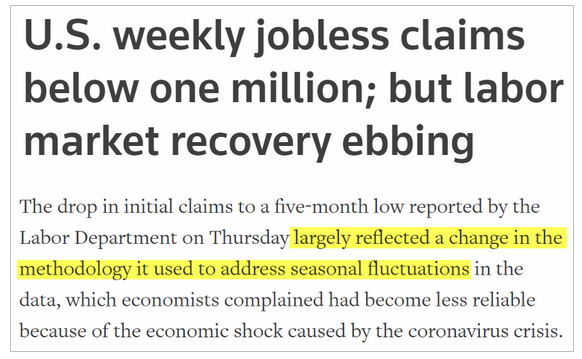

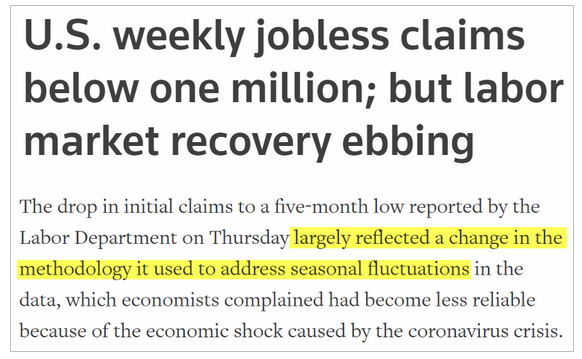

2. Has politics entered our economic data too?

Source: The Daily Shot, from 9/4/20

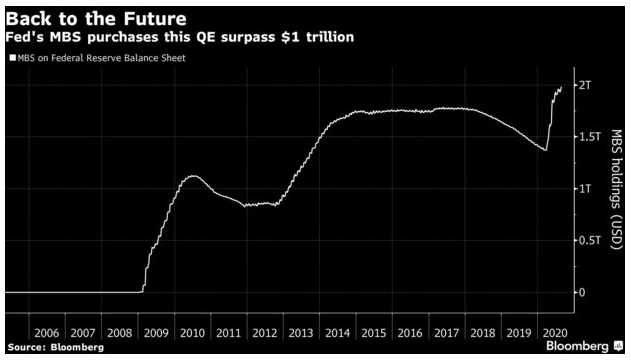

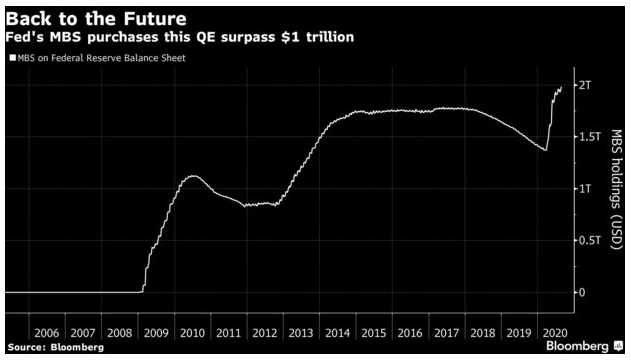

3. The Fed continues to help keep mortgage rates low…

Source: Bloomberg, from 9/3/20

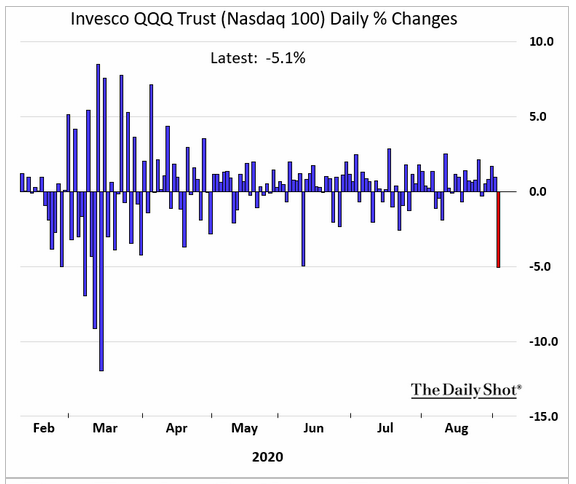

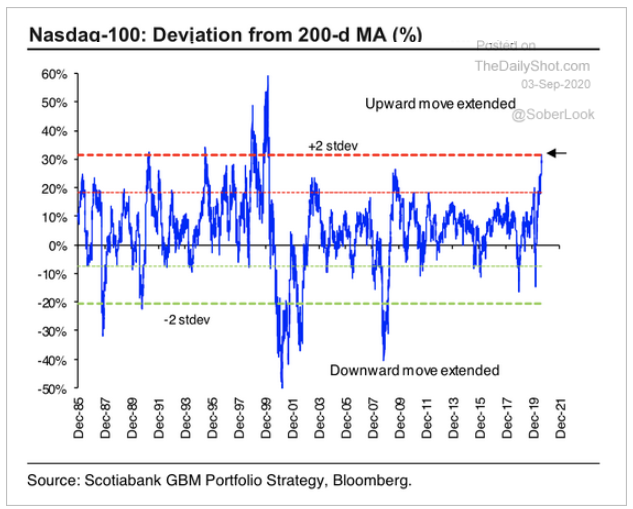

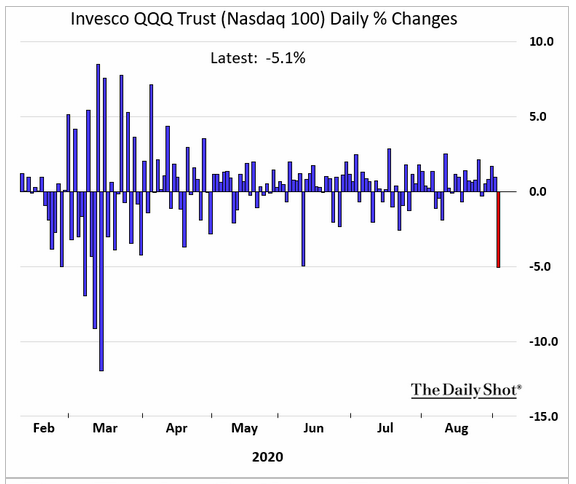

4. Yesterday was a reminder that nothing can go up forever…

Source: The Daily Shot, from 9/4/20

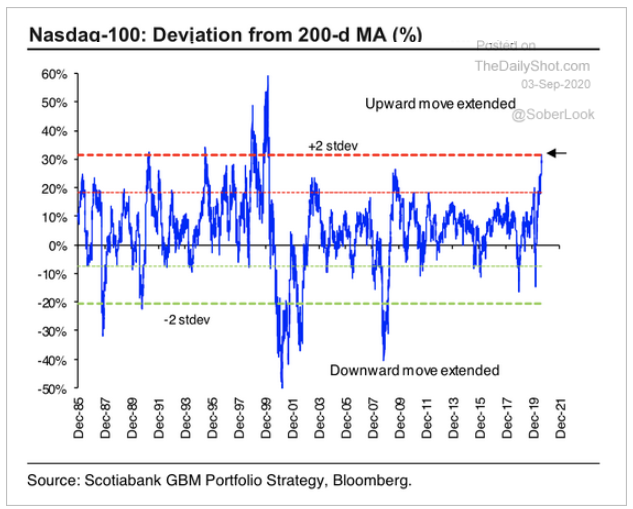

5. Open option contracts, stay at home retail investors and the “where else do I go?” viewpoint is driving the NASDAQ to extremes. The good news is the extreme, as seen in 1997 and 1999, can extend a long time!

Source: The Daily Shot, from 9/3/20

6. Only 30% of the S&P 500 is at new highs…

Source: The Daily Shot, from 9/3/20

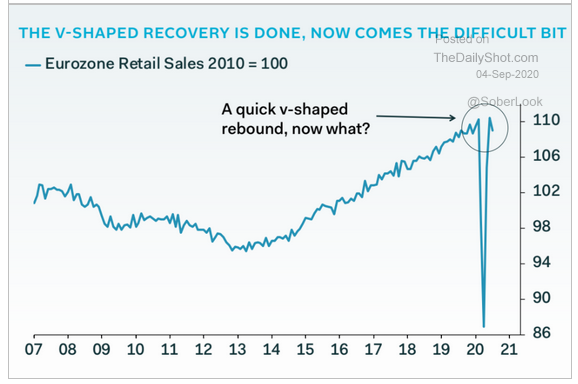

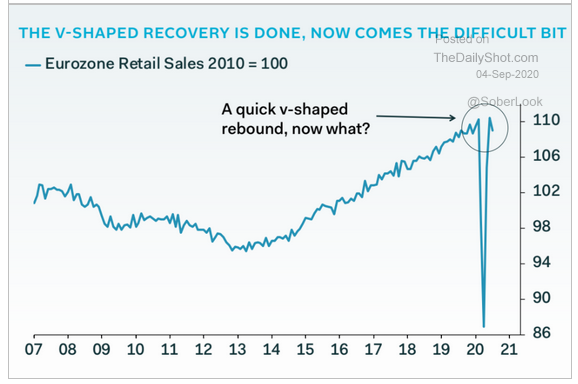

7. European services and retail sales declined last month as the second wave of Covid hit the continent…

Source: The Daily Shot, from 9/4/20

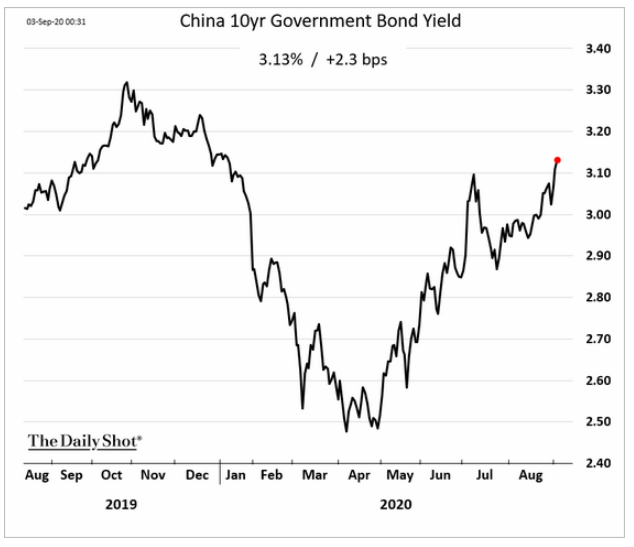

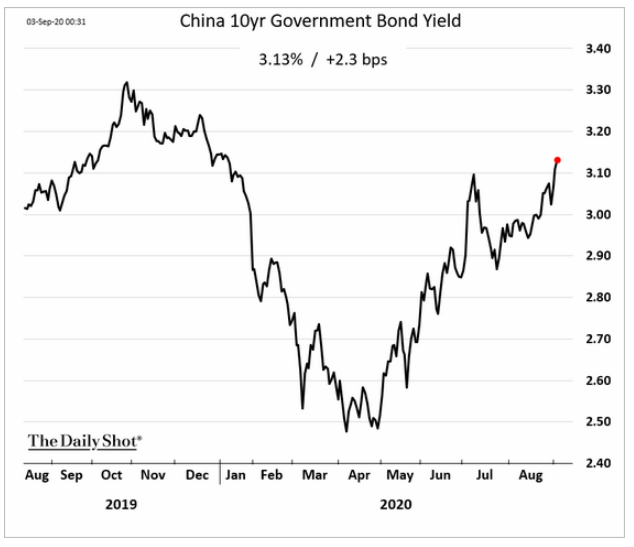

8. Chinese bond yields are steadily grinding higher, boosting their currency…

Source: The Daily Shot, from 9/3/20

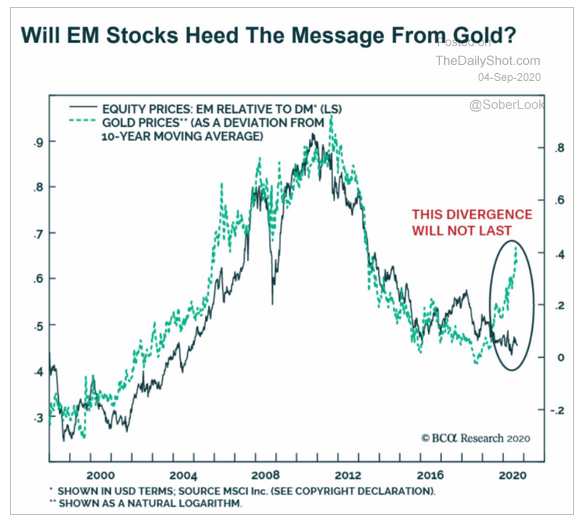

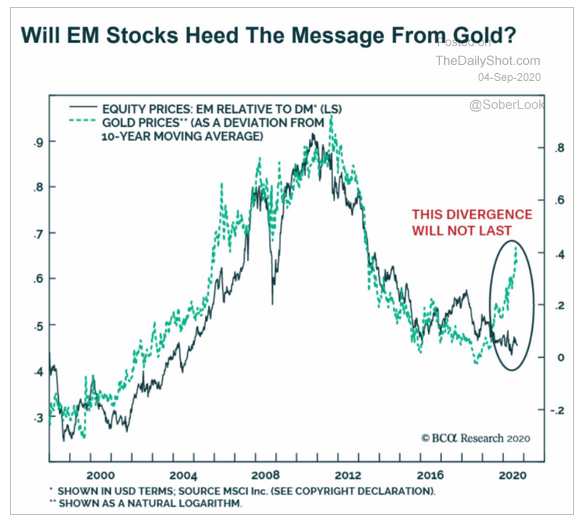

9. Interesting… which one is “right”?

Source: The Daily Shot, from 9/4/20

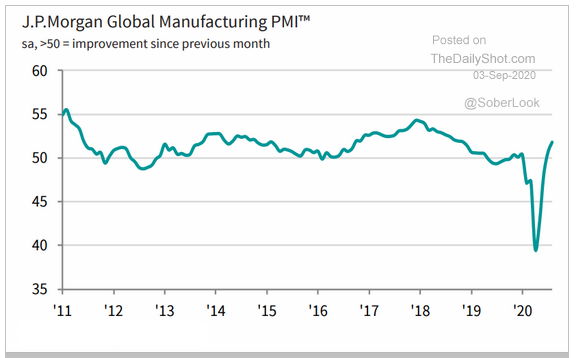

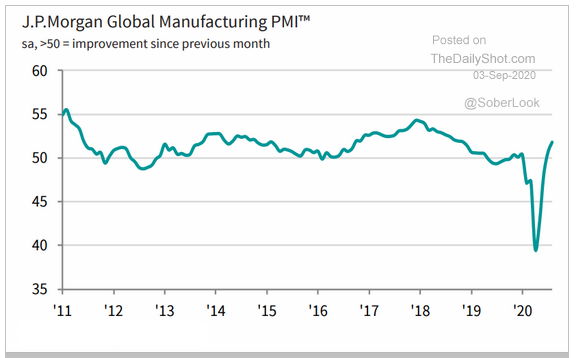

10. Global manufacturing has fully recovered. But…

Source: J.P. Morgan, IHS Makit., from 9/3/20

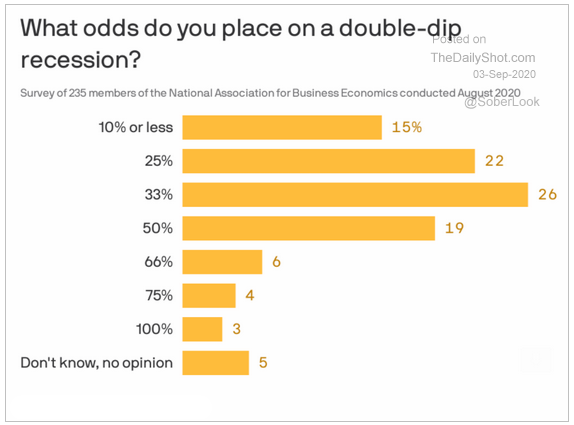

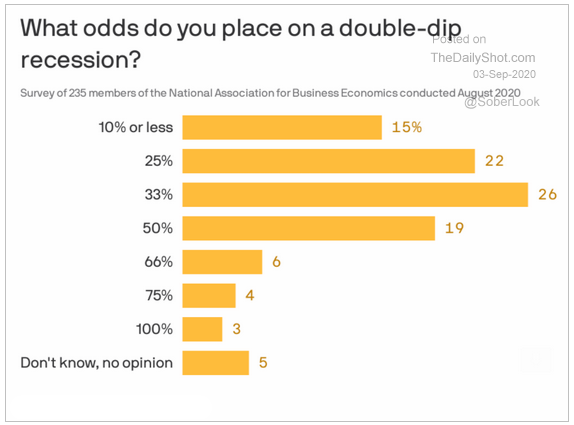

11…Many economists believe a double-dip recession may be in the cards. Hopefully a vaccine will treat more than the virus!

Source: The Daily Shot, from 9/3/20