Written by Allison Marchese

Factor Investing in the 2019 Landscape

April 4, 2019 | ECONOMICS & INVESTING

Factor investing has become one of the fastest growing investment approaches in asset management, experiencing 11% organic asset growth per year since 20111. However, factor investing is certainly not new, and while the factor investing landscape may be evolving and gaining popularity, asset managers have been using this approach for over half a century. Here is a quick refresher on the most popular factors and their key characteristics:

Factor |

Aims to Capture Excess Returns (Risk Premia) From… |

Determined Primarily By |

| (High) Dividend Yield | Stocks that pay higher-than-average dividends (portion of the company’s earnings paid to shareholders) consistently over time | Dividend yield, cash flow to cover the dividends |

| (Positive) Momentum |

Stocks with steady upward price trends |

Relative, shorter-term returns (3-month, 6-month, 12-month) |

| (High) Quality |

Stocks of financially healthy, more stable companies |

Return on Equity (ROE), earnings stability, strength of balance sheet, financial leverage (debt), corporate governance, cash flows |

| Size (Small Cap/Mid Cap) |

Smaller companies that can experience higher growth rates relative to their larger counterparts |

Market capitalization (full or free float) |

| Value | Stocks whose prices are discounted relative to their current fundamentals | Price-to-book (P/B), Price-to-earnings (P/E) |

| (Low) Volatility |

Stocks with lower volatility relative to the broader equity market |

Standard deviation (1-year, 2-year, 3-years), beta to the S&P 500 |

Here are some important things to remember about factors, many of which we wrote about in our 2016 blog post:

- Factor investing, or “smart beta” seeks to provide excess returns on an absolute or risk-adjusted basis, more targeted risk exposures, and can provide more differentiated investment options.

- Factors are cyclical in nature and tend to fall in and out of favor in different market environments, sometimes for long periods of time. This creates opportunity (and risk)!

- The factor exposures are not exclusive and often overlap. For example, high quality stocks may also have high dividends and offer fundamental value.

- On the other hand, when you own a portfolio of long-only factor ETFs, your largest risk exposure is to the market as a whole, and your portfolio is likely subject to the same downside risk and volatility as the S&P 500 Index.

As we mentioned above, factors are common characteristics found in a group of stocks that explain the group’s risk and return behaviors. In addition, they all experience periods of over and underperformance based on macroeconomic influences and market conditions. So how do you get the most out of factor investing? That being said, it’s important to understand why we use factor ETFs and which factors are affected by different market environments or business cycle phases (such as economic growth, interest rates, and inflation). Here, we break this down by factor:

Dividend Yield: This factor tends to underperform when interest rates are rising, and the yield curve is steepening. Similar to Quality, high dividend yielding stocks tend to hold up better during periods of market turmoil

Momentum: The momentum factor is essentially seeking excess returns by taking on the risk of riding a stock that is “trending” higher. This factor is subject to underperformance in fast-moving markets or drop-offs that break upward price trends suddenly.

Quality: Companies within the quality factor tend to be more resilient in broader market sell-offs due to their stable earnings and earnings growth. Overall, investors tend to look towards higher-quality companies during periods of stress or market failure.

Size: Smaller companies tend to outperform during periods when economic growth prospects are positive. Conversely, when the economy stutters or slows, this factor typically underperforms. It is a lot easier to grow earnings from $10 million to $20 million versus $10 billion to $20 billion.

Value: This factor typically includes securities based on their price in comparison to various fundamental metrics, purchasing those that appear cheaper. However, the value factor is highly subject to broad-based sell-offs, as undervalued or “cheaper” companies can have risk characteristics (such as a high dependency on earnings expectations or high outstanding debt) that make investors nervous and more likely to sell quickly if earnings falter and P/E shifts.

Volatility: The key to the low volatility factor is that it’s relative to broad market conditions. Generally, when the entire market is in a period of high volatility, this factor has historically added value and provided some downside protection by favoring stocks with more stable prices. Conversely, when the broad market is experiencing a period of low volatility, this factor typically underperforms.

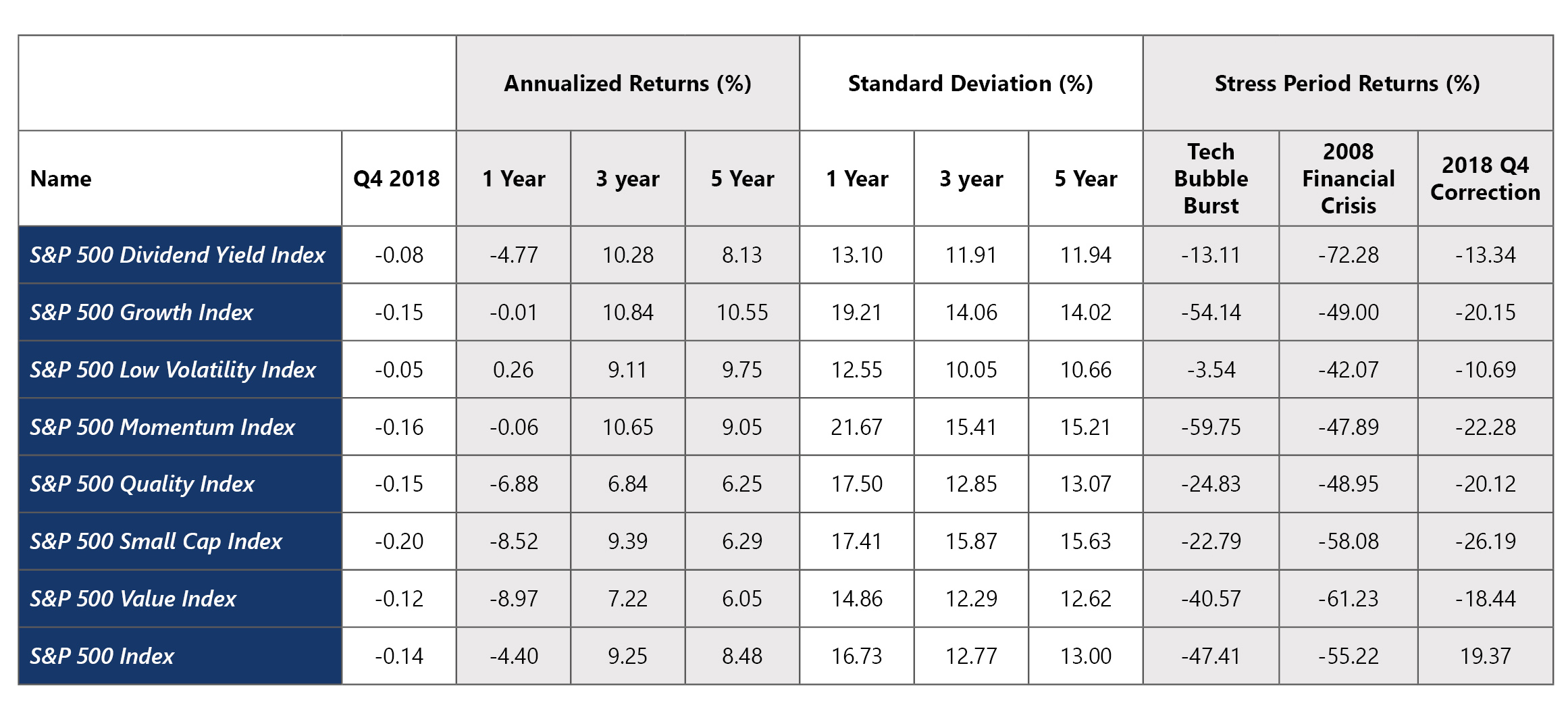

Source: Beaumont Capital Management (BCM), Bloomberg, April 2019. “Tech Bubble Burst” is defined as the period between 9/1/2000-10/9/2002. “2008 Financial Crisis” is defined as the period between 10/9/2007-3/9/2009. “2018 Q4 Correction” is defined as the period between 9/20/2019-12/24/2019. Past performance is not indicative of future results.

With a better understanding of when and why certain factors out- or under-perform, it’s easy to see why a defensive element in your factor ETF portfolio could be useful. Why let “out of favor” factors detract from potential excess returns? BCM’s smart beta strategies have different processes, but both seek to provide attractive risk-adjusted returns while focusing on avoiding large market losses during bear markets. Learn more here.

Sources and Disclosures:

¹BlackRock, as of 12/31/17

Copyright © 2019 Beaumont Capital Management (BCM). All rights reserved.

Past performance is no guarantee of future results. Diversification does not ensure a profit or guarantee against a loss.

As with all investments, there are associated inherent risks including loss of principal. An investment cannot be made directly in an index.

Factor investments concentrate in a particular industry and the investments’ performance could depend heavily on the performance of that industry and be more volatile than the performance of less concentrated investment options and the market as a whole.

This material is for informational purposes only. It is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument, nor should it be construed as financial or investment advice.

The views and opinions expressed throughout this presentation are those of the author as of April 4, 2019. The opinions and outlooks may change over time with changing market conditions or other relevant variables.

“S&P 500®” is a registered trademark of Standard & Poor’s, Inc., a division of S&P Global Inc.

Popular Posts

- Mini-Cycles, Manufacturing, and Mounting Debt

- ‘De-Worsifying’ Equities, U.S. Dividends Fail to Measure Up, and Are Junk Bond ETFs Turning to Junk?

- 2Q24 Market & Strategy Review: Betting on Broadening

- Factor Investing: Smart Beta Pursuing Alpha

- Tactical to Practical: Understanding the Importance of Types of Market Declines