Today kicked off with reignited recession fears as the 2-10 yield curve officially inverted for the first time since 2007—an event which preceded each of the last seven recessions. This lends credence to Bank of America’s assessment that the U.S. has a greater than 30% likelihood of entering a recession within the next year. Yields have continued to drop across the globe, including Australia and New Zealand—which have typically retained fairly high yields—and Germany and the Netherlands, trading 100% of bonds with negative yields. Meanwhile, the U.S. posted stronger-than-expected CPI for July, indicating a rise in inflation as price hikes due to tariffs are starting to be passed on to consumers. Stocks rallied a bit this morning following President Trump’s announcement that he will delay implementing fresh tariffs on China until December 15th to avoid an impact on holiday spending—one of his first public acknowledgements that the trade war can negatively affect the U.S. consumer—but the recovery was short lived as the Dow later tumbled over 700 points on recession fears.

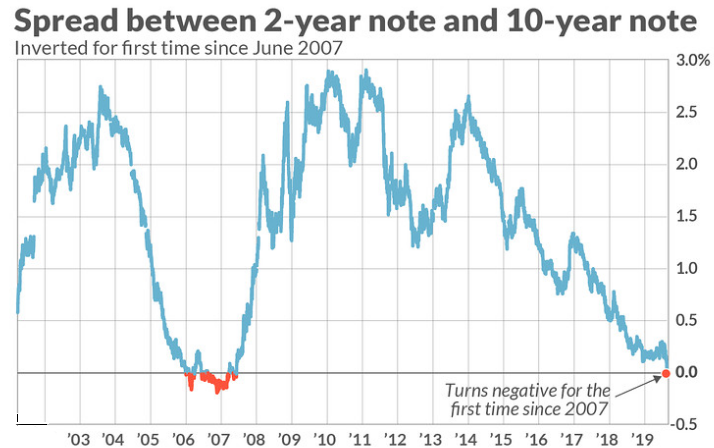

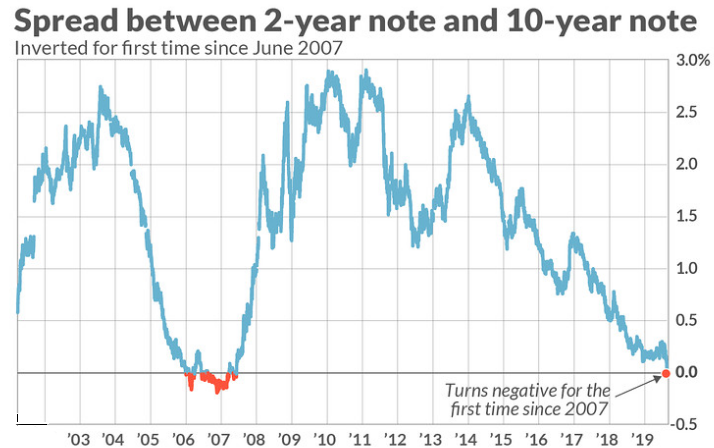

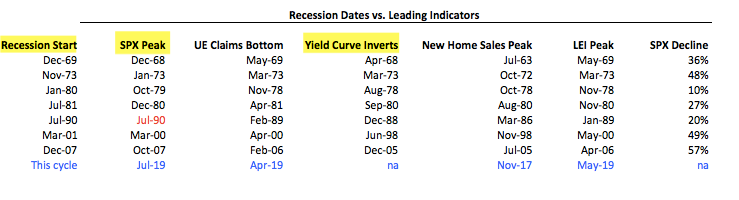

1. As the yield curve inverts for the first time since 2007, investors may be justified in feeling a bit uneasy based on the track record of this indicator. However, it is also important that yield curve inversion is purely a coincidental indicator of recession rather than a cause.

Source: Federal Reserve Bank of St. Louis & Twitter, as of 8/14/19

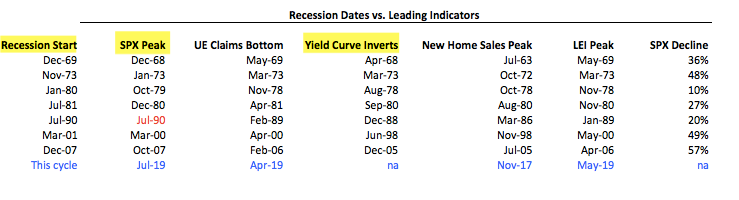

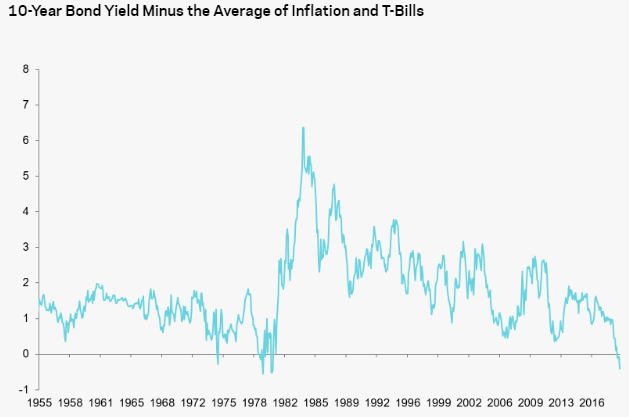

2. Based on yields relative to inflation as well as forward yields, bonds are nearly the most “expensive” they have been in modern history.

Source: AQR, as of 8/14/19

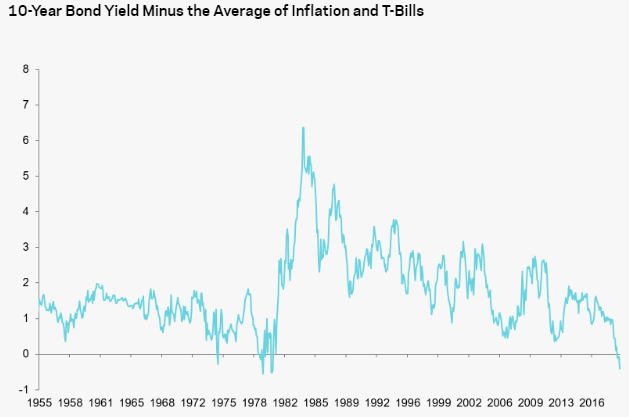

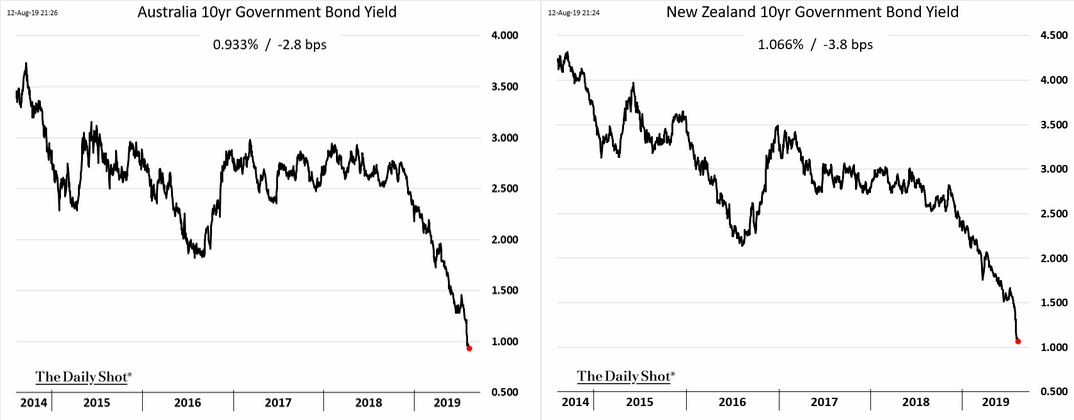

3. Even the rates of traditionally “high-yielding” sovereigns are plummeting.

Source: WSJ Daily Shot, as of 8/13/19

4. And check out what percentage of each country’s debt trades with negative yields!

Source: Deutsche Bank Research, as of 8/14/19

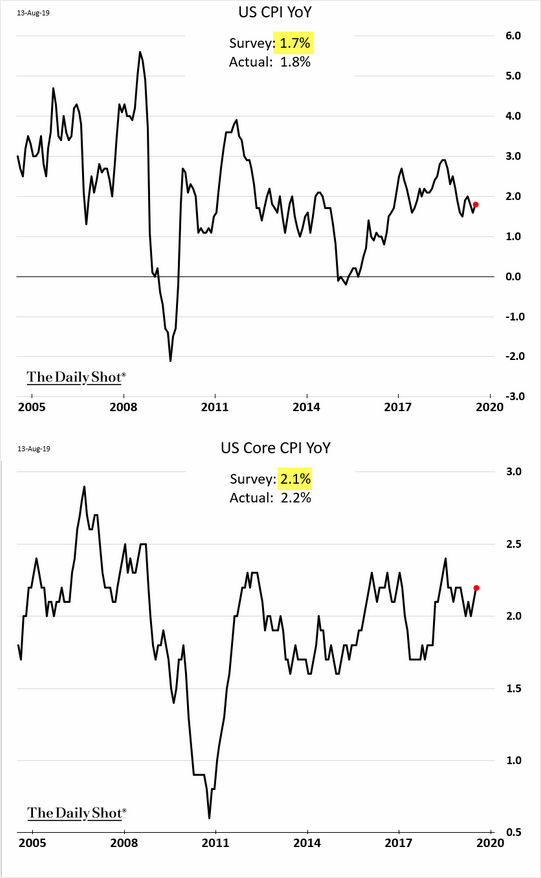

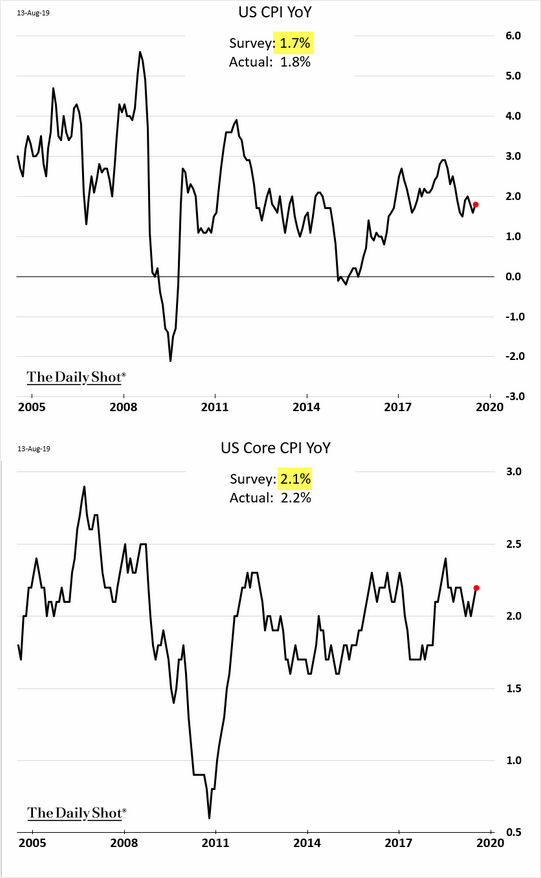

5. The July U.S. CPI report was stronger than expected, and indicates a rise in inflation.

Source: WSJ Daily Shot, as of 8/14/19

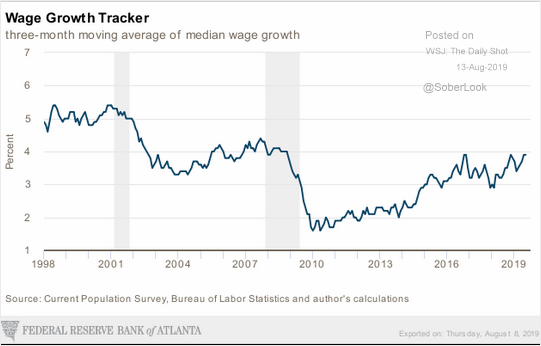

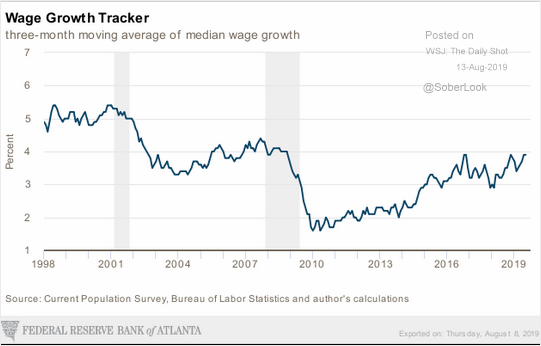

6. And wage growth has remained strong.

Source: WSJ Daily Shot, as of 8/13/19

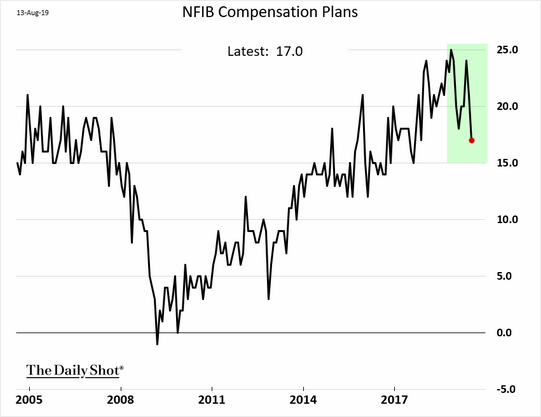

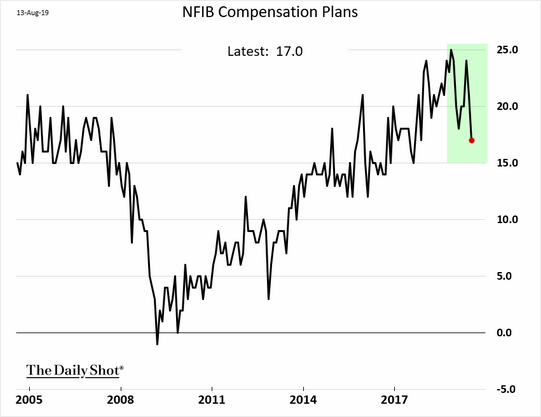

7. But it may be short lived…

Source: WSJ Daily Shot, as of 8/14/19

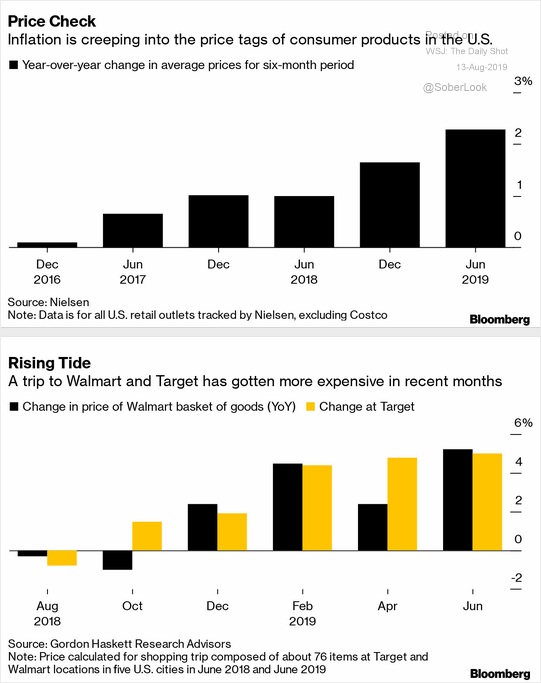

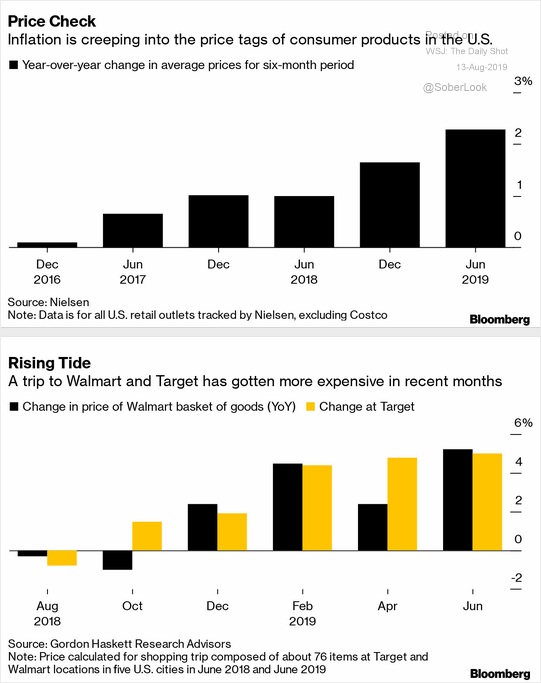

8. Which is bad news for the consumer, as the cost of tariffs is making its way into the retail market.

Source: Gordon Haskett Research Advisors, as of 8/13/19

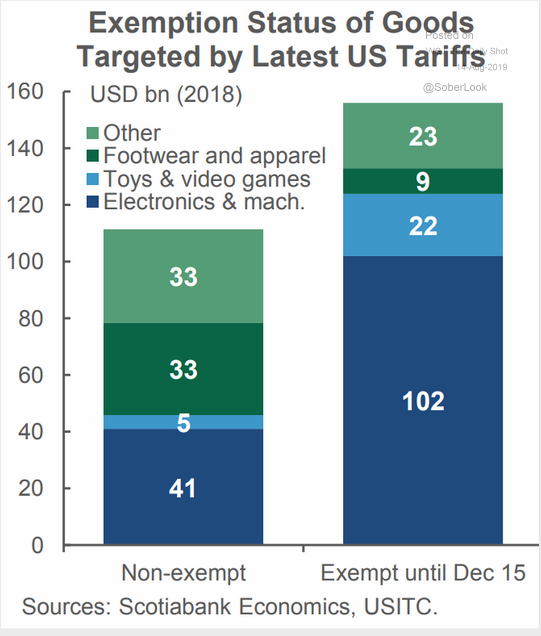

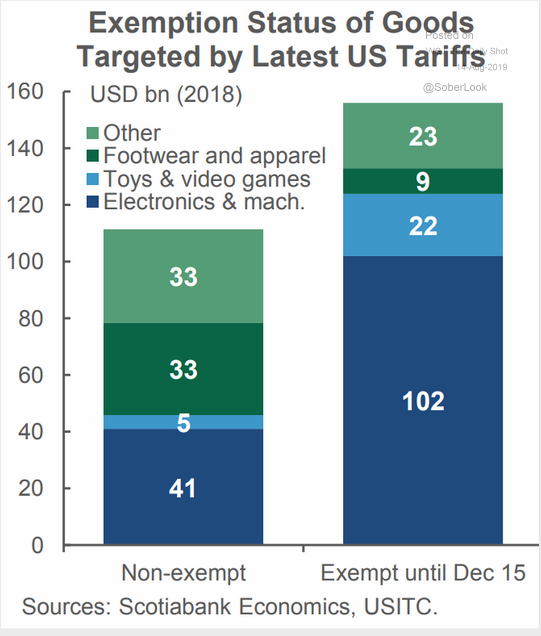

9. But President Trump has delayed imposing the newest round of tariffs until December 15th, to avoid a drag on holiday spending.

Source: Scotiabank Economics, as of 8/14/19

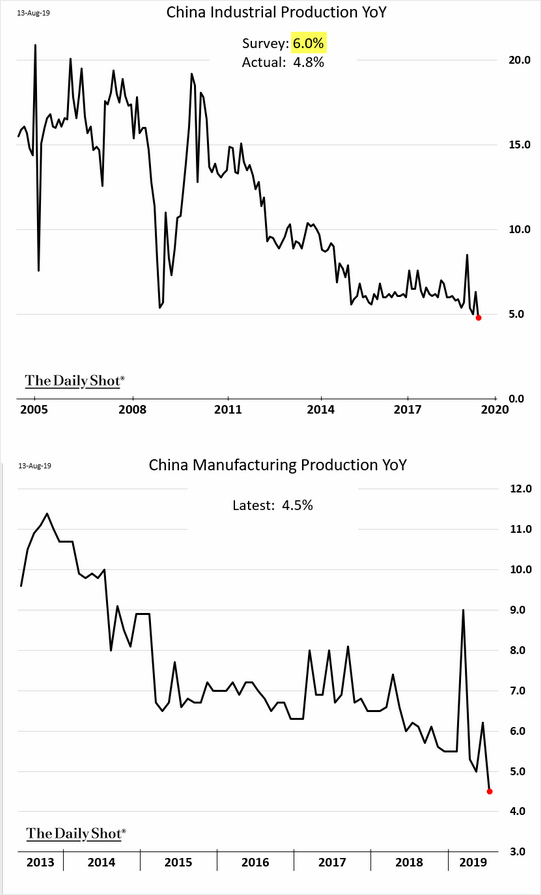

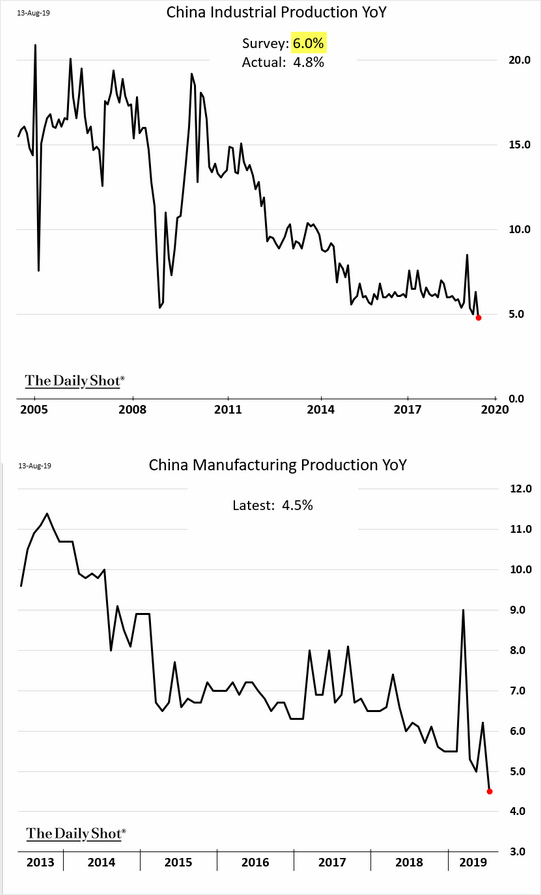

10. Despite this reprieve though, the Chinese economy is continuing to slow.

Source: WSJ Daily Shot, as of 8/14/19

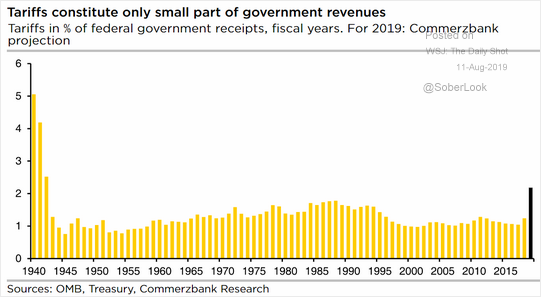

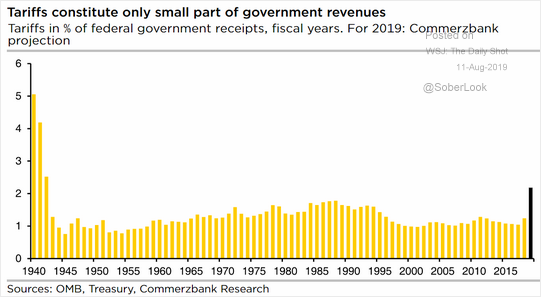

11. Is all this back and forth worth it for such a small return?

Source: Commerzbank Research, as of 8/11/19

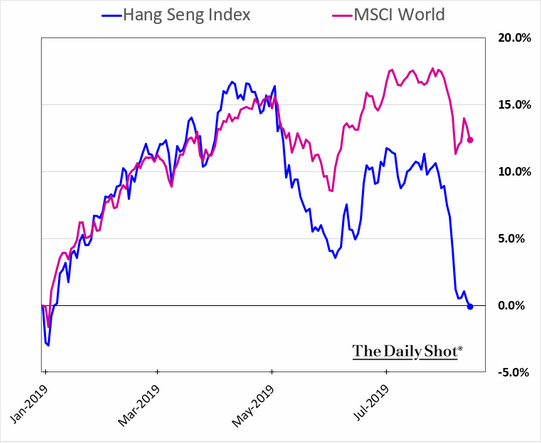

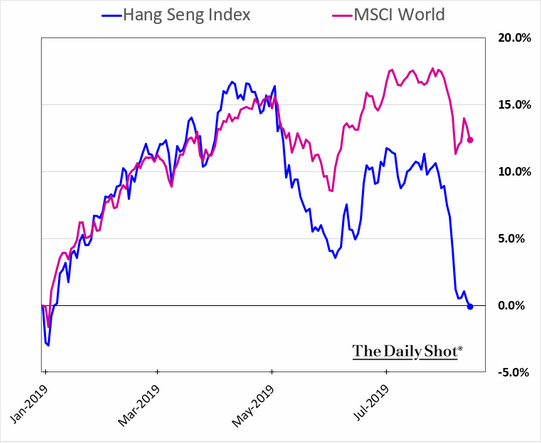

12. The protests in Hong Kong are having a clear effect on its stock market.

Source: WSJ Daily Shot, as of 8/13/19

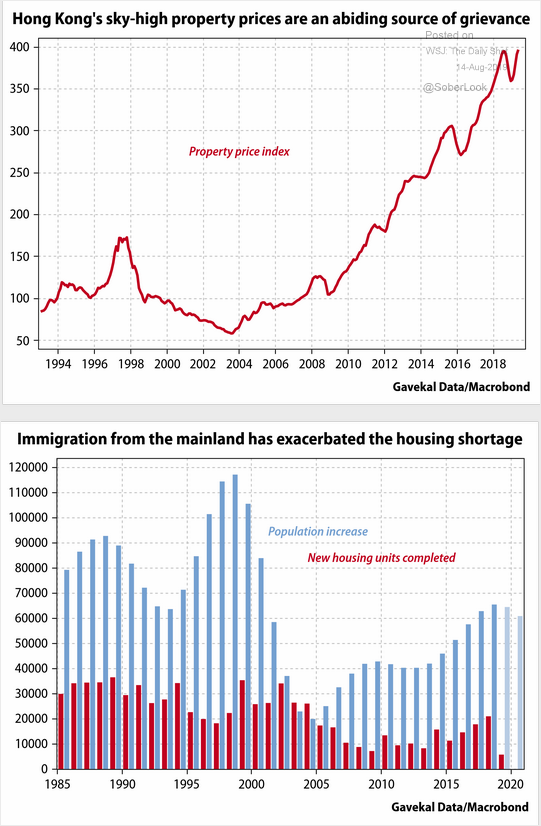

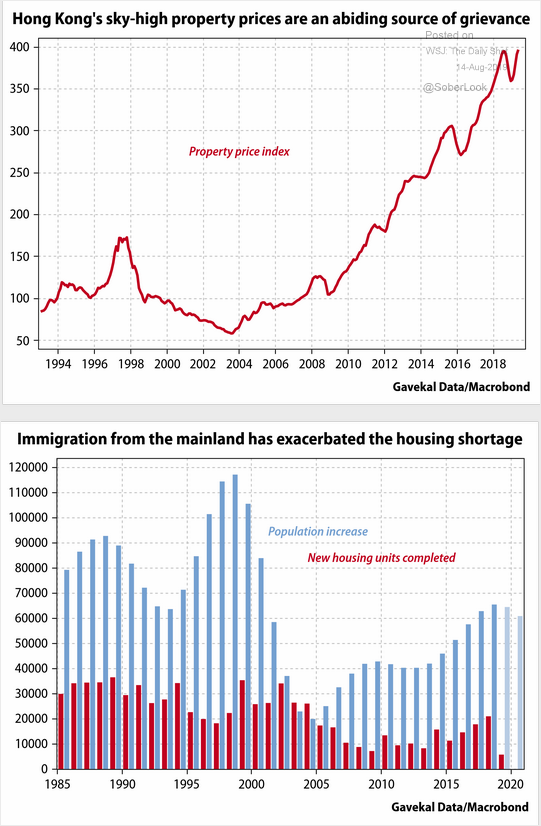

13. And sky-high property prices and housing shortages only add to the citizens’ mounting frustrations.

Source: Gavekal Data/Macrobond, as of 8/14/19